Foreign Exchange

The confidence in the rupee remains strong: stronger against the U.S. dollar

and Japanese Yen but weaker against the Euro and Pound Sterling. Against a

basket of 36 currencies, as of end September (data as of end October is not still available), the rupee was stronger by 2.5% over the preceding eleven months.

Indian equities have put in a super performance – the

benchmark Sensex is up by more than 20%! Although corporate earnings have been

weak on the back of a significant slowdown in the economy, equities have been the best performing

asset class. Equities generally factor in expectations of the future, so it

seems that the equities market is projecting that demonetisation, GST, and

various other measures of the government are going to be net positive for the

long term growth of the economy.

The picture on bonds is interesting. Bond yields have fallen

up to 3 years, but risen slightly from 5 to 10 years – so that the yield curve

has steepened. This seems to support the view from the equities market that the

long term growth of the economy has not been jeopardised by demonetisation and

GST. On balance, the bond market has returned a positive return over the last

year.

Gold has generated a negative return as a result of the

stronger Rupee (against the U.S. dollar).

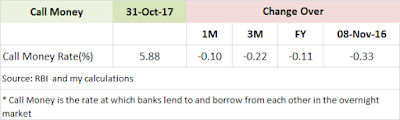

RBI continued with its accommodative monetary policy

post-demonetisation but then shifted gear to a neutral stance in Fenruary this year.

SBI and ICICI Bank – the

largest in the public and private sectors – reduced deposit rates, but unlike

the government bond market, more in long term deposits than in short term

deposits. Significantly, both banks reduced their S.B. account rate by 0.5%, the

first such change since deregulation in 2011.

There has been a significant reduction in SBI's rate.

Real Estate

very useful at a glance and updated!

ReplyDelete