Monetary conditions have already tightened

Looking at FY 18-19, RBI expects inflation to end the year

at about 4.5%. This year, FY 17-18, RBI

expects inflation to be 5%, about 0.5% higher than its original estimate.

Growth is expected to pick up in 2018-19 to 7.2% from 6.6%

this year.

Capacity utilisation continues to be low – in the low 70’s.

Credit growth is still running low – just 6.5% during FY

17-18 up to March 2, the last data point available. Now deposit growth has also

slowed - just 4% for the same period.

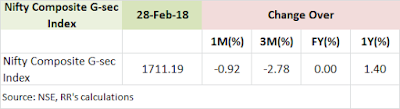

In fact, monetary conditions have tightened – one year treasury

bills yield about 6.7%, 0.4% more than when the RBI last reduced the repo rate

in early August 2017. The same has been the case with the 10 year treasury bond

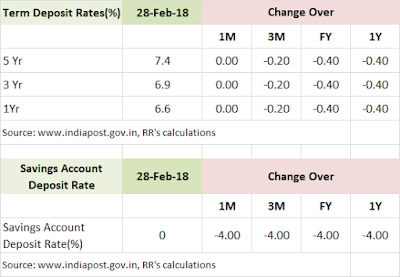

– yields are up by more than 1%. In recent days some banks have raised both deposit rates and

lending rates. SBI, India’s largest bank, is in this list. The rupee on real effective rate basis has continued to get overvalued over the last year.

RBI perversely has had a significant role to play in the response by the bond market: in February last year the RBI inexplicably shifted

its stance from accommodative to neutral, and to make matters worse followed

this up in August with a reduction the repo rate! The worsening fiscal

situation of the government has also played a role.

With the one year rate at 6.7%, and the one year inflation

forecast at about 4.5%, real rates are solidly high about 2%.

Please read my earlier blogs on this topic, inluding my last July's blog.