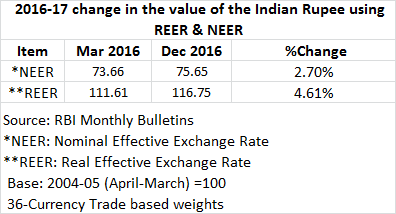

Rupee at its highest level since April 2004 on a real exchange rate baisis

Friday 20 January 2017

Wednesday 18 January 2017

The flow of money up to Q3 2016-17: what do the numbers tell us?

Credit growth exceptionally weak - post-demonetisation credit growth has been nil

Deposit and credit growth

Credit growth just 1.4% even though three quarters of the financial year is over (RBI's last reporting date for Q3 was December 23, 2016).

Post -demonetisation, credit growth has been nil!

On December 23, 2016, outstanding credit was Rs. 73,480 bill, marginally lower than the amount outstanding on November 11, 2016 (the first reporting period after demonetisation) of Rs. 73,532 bill.

Deposit and credit growth

Credit growth just 1.4% even though three quarters of the financial year is over (RBI's last reporting date for Q3 was December 23, 2016).

On a year-on-year basis, the number is half that of the previuos year.

Post -demonetisation, credit growth has been nil!

On December 23, 2016, outstanding credit was Rs. 73,480 bill, marginally lower than the amount outstanding on November 11, 2016 (the first reporting period after demonetisation) of Rs. 73,532 bill.

Money Supply

The sharp deceleration in money supply growth as measured by M3 - the sum of currency in circulation, demand and time deposits- is explained by the fall in absolute level of money supply post-demonetisation: since the first reporting period of November 11, money supply has fallen from Rs. 123,767 bill. to Rs. 120, 449 bill.

In an ideal world this should not happen : demonetised notes get surrendered to the bank and then they become deposits; so as one component of money supply falls, the other rises. In India's case currency in circulation has fallen, but demand and time deposits have not risen by the same amount, leading to a net fall in money supply by Rs. 3,300 bill. Why?

This could be a technicality, in my view, because when one looks at the sources of money supply growth (the equal flip side of the components of money supply), there is a Rs. 3800 bill. rise in banking sector's non-monetary liabilities, which perhaps are deposits but which have temporarily not been reported as such by banks for some reason.

Reserve Money

Reserve Money - also known as high-powered money because changes in this could have multiplier effects on money supply - has collapsed post-demonetisation: from Rs. 22,490 on November 11 to Rs. 14, 355 bill. on December 30 (RBI's last reporting date for Q3). This accounts for the sharp fall in reserve money growth in the current financial year. The components of reserve money are currency in circulation, bankers' deposits with RBI, and other deposits with RBI.

This is what seems to have happened: to mop up the surge in liquidity in banks, the RBI sold government securities; this led in turn to a sharp fall in net RBI credit to government by Rs. 5900 bill. - one of the sources of variation in reserve month growth (the flip side of the components of reserve money) ; liquidity was also absorbed by RBI by a sizable fall in its net credit to banks and the commercial sector by Rs. 1800 bill. - another source of variation in reserve money growth.

So, here again, it appears the overall collapse in reserve money growth may be a technicality - it being reflected as a reduction in assets rather than as a rise in liability of the RBI in the form of deposits by banks with the RBI, which is a component of reserve money.

Monday 9 January 2017

Indian Stock Market Watch: Margin funding of investors by brokers dips in Q3 of 2016-17

Margin funding as a percentage of cash trading on a month-end basis reaches highest level since December 2012.

Please also read my blog earlier blog on this subject.

Tuesday 3 January 2017

Monitoring the NaMo Bull Market in Stocks: Update as of December 2016

Indian Stock Market Watch

Please see my blog of July 9, 2014 for the original note on using TMV/GNP ratio to gauge whether the market is cheap or expensive.

Subscribe to:

Posts (Atom)