A bird’s eye view of the performance of India’s financial markets on a monthly basis.

Equities have been the best asset class over the last one year. And even the current financial year (the pound/rupee rate has done a little better, but this is due to the sharp fall od the pound following the one-off Brexit).

Over the last one month, bond yields have fallen in the 3-6 month area, but have risen for longer maturities. Longer maturity yields have clearly responded to the change in the monetary policy stance of RBI in the second week of February from accommodative to neutral.

In this scenario, my remark that "accommodative and neutral policy coexist" seems to be true.

However, over three months, a few weeks after demonetisation, yields have risen across the board. What explains this? Profit taking by market participants or a perception that the demonetisation effects are going to short and temporary? I am not sure.

Note, it makes some sense for a saver to put his 5-year money in the government bond rather than put it in a ICICI or SBI deposit.

Of course, a 5-year Post Office deposit is better. Note this may change, as government has made a commitment to move small savings rates in line with market rates. The RBI's monetary policy statement of three weeks ago urges government to move in step as agreed.

Foreign Exchange

Stock Market

Gold

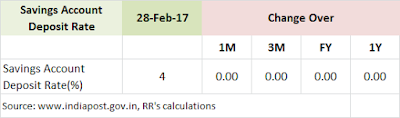

Post Office Deposits

Lending Rate

Real Estate Market

No comments:

Post a Comment