Tuesday, 17 December 2019

Tuesday, 3 December 2019

Fifth Bi-monthly Monetary Policy Statement, 2019-20 : RBI should reduce the repo rate by 0.5%

Let's

look at some data points to support my suggestion that the MPC (in the

statement to be released on December 5, 2019) should reduce the repo rate

to 4.85% from the current 5.15%.

The

economy has fallen off the cliff - for six consecutive quarters growth has

slowed from 8.1% in Q4 of 2017-18 to 4.5% in Q2 OF 2019-20. Inflation has been

benign and well below RBI’s target of 4%: except for last month's number of

4.69%, since July 2018 there has not been a single month when CPI inflation

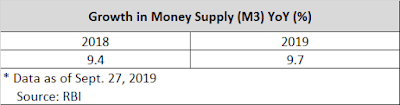

crossed 4%. Bank credit, the fuel that runs the economy has been at astandstill this financial year.

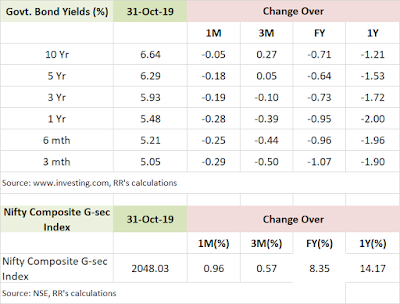

The

international inflation environment has been benign. World growth has been

tepid. The ECB, the Federal Reserve and Japan's central bank are in a easing mode.

About $15 trillion of bonds, including some corporate bonds, in the developed

world have negative yields.

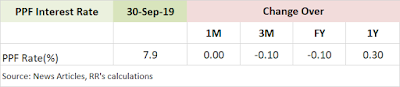

Given the

crisis of growth of India's economy, there is a strong case for the RBI to

focus its energy on stimulating growth. To stimulate growth using the

interest rate as a policy tool, the RBI needs to sharply reduce the real

interest rate - surely to 0.5% or even to zero for a suitable period of time.

The real

interest rate prevalent in the economy is just too high. The table below gives

the one-year treasury bill rate, CPI inflation, and the real rate, which

is the difference between the two. As one can see, the real rate, as per this

measure, has been well above 2%, which was at one time the target of the RBI.

The RBI

needs to target a real rate of 0.5% or even zero. I feel that even if inflation

perks up for the rest of the financial year to about 5% - a worst case scenario

- there is still a case for a near zero real interest rate to stimulate growth.

A repo

rate of 4.85% is quite consistent with this goal.

Please

see my earlier blogs on monetary policy, which will give a full background to

my stance, in particular two notes titled A review of monetary policy: there is a serious need to correct flawed

policy execution of June 5, 2109 and Monetary

Policy: A look back over the last year of July 27, 2017.

Wednesday, 6 November 2019

Fourth Bi-monthly Monetary Policy Statement, 2019-20: Another well deserved round of easing

This time round the MPC reduced the repo rate by 0.25% instead of 0.35%. I am all for easing the repo rate. Please see my blog dated June 5, 2019 titled "A review of monetary policy: there is a serious need to correct flawed policy execution".

Things are pretty dire on the growth front: RBI reduced its estimate of GDP growth for 2019-20 from 6.9% to 6.1% - practically a 1% reduction is a huge adjustment. In this context, please see the virtual halt to the growth of credit in H1 OF 2019-20

Inflation projection for H2 of 2019-20 remains at 3.6%.

Things are pretty dire on the growth front: RBI reduced its estimate of GDP growth for 2019-20 from 6.9% to 6.1% - practically a 1% reduction is a huge adjustment. In this context, please see the virtual halt to the growth of credit in H1 OF 2019-20

Inflation projection for H2 of 2019-20 remains at 3.6%.

Monitoring the Bull Market in Indian Stocks: Update as of October 2019

Please see my blog of July 9, 2014 for the original note on using TMV/GNP ratio to gauge whether the market is cheap or expensive, and my monthly blogs on this subject.

Wednesday, 16 October 2019

Tuesday, 15 October 2019

Monday, 14 October 2019

Monitoring the Bull Market in Indian Stocks: Update as of September 2019

Subscribe to:

Comments (Atom)